For the RECOrd: August 2025

In this issue

RECO service standards

RECO is committed to providing timely and effective assistance. Each quarter, RECO reports on a set of service standards and benchmarks related to application and complaint processing, as well as response times when contacting RECO by phone. Check out our most recent report on how RECO is performing against its targets on RECO’s website.

Legal corner: Multiple clients in the same trade leads to unfair competing offer process

A recent case highlights the importance of disclosing when a brokerage has both a seller client and one or more buyer clients in the same trade, even if the clients are represented by different representatives. Failure to disclose can result in penalties under the Trust in Real Estate Services Act, 2002 (TRESA).

Key facts of the case

- Two agents from the same brokerage represented the seller in the sale of their property.

- The listing for the property indicated that the seller would review all offers on a specific date. The instructions also indicated the seller requested that offers be made irrevocable for 24-48 hours.

- The seller’s agents received offers from six different buyers. One of the offers was from a buyer represented by the seller’s brokerage, and this was disclosed to all buyers via email.

- All offers were conveyed to the seller, and while negotiations were underway, a seventh buyer contacted the seller’s agent to express interest in submitting an offer.

- The seventh buyer, now represented by one of the seller’s agents, submitted an offer on the property. The seller’s agents did not notify the other buyers or their agents that the seller’s agents was representing both the seller and the seventh buyer.

- The seventh buyer was successful in purchasing the property.

Decision

The discipline panel found that the seller’s agents failed to notify all buyers involved in the trade that their brokerage was in multiple representation and that they were representing a competing buyer client’s offer. The panel found a breach of s. 17 of the REBBA Code of Ethics and ordered a fine of $10,000 for each of the seller’s agents, along with a requirement to complete an educational course.

It is important to note that designated representation was not in effect when this case occurred, as it pre-dated the introduction of TRESA.

What agents need to know

Though the above case occurred while REBBA was in force, it’s important to understand how the scenario is handled under TRESA. First and foremost, a brokerage or designated representative is prohibited from representing more than one client in a trade unless:

- the brokerage makes the mandatory written disclosure,

- the brokerage makes best efforts to obtain an acknowledgement that the required disclosure was received, and

- after receiving the disclosure, if each of the existing or prospective clients agree, the clients provide written consent to the brokerage or designated representative continuing to represent them in respect of the trade.

When these criteria have been met, multiple representation under TRESA can arise in two situations:

- Under brokerage representation, multiple representation arises when the brokerage has a seller client and one or more buyer clients in the same trade, or the brokerage has one or more competing buyers in the same trade.

- Under designated representation, multiple representation can occur when the same agent is the designated representative for a seller client and one or more buyer clients in the same trade or the same agent is the designated representative for more than one competing buyer in the same trade.

In this case, one of the seller’s agents was engaging in multiple representation. However, it is not just multiple representation by an agent that requires disclosure to other parties, a brokerage has important disclosure obligations:

- If a brokerage has a seller client and a buyer client in the same trade, the brokerage must disclose this fact to every other buyer who makes a written offer.

- The disclosure must be made as soon as possible after an offer is received, and before any offer is accepted by the seller.

- The disclosure must be clear that the brokerage has a seller client and buyer client in the same trade – but distinctly different from the multiple representation disclosure and consent obtained by both clients prior to proceeding.

- The disclosure requirement applies even when the seller and buyer are represented by different designated representatives, but would not apply if a brokerage has multiple buyer clients in a trade.

- The disclosure should be provided in writing to all prospective buyers’ agents, or to a self-represented party buyer directly. Best efforts must be made to obtain acknowledgement from all prospective buyers that the required disclosure has been made.

Additional information

The TRESA obligations arise from the General Regulation O. Reg. 567/05

Disclosure of multiple clients to buyers

22.0.3

- If a brokerage provides services to a seller and a buyer in respect of the same trade in real estate, the brokerage shall, as soon as possible after receiving a written offer from the buyer and before an offer is accepted, disclose this fact to every other buyer who makes a written offer. O. Reg. 235/23, s. 9.

- A brokerage shall make best efforts to obtain a written acknowledgement from each person receiving a disclosure under subsection (1) indicating that the disclosure has been received and, if a person makes the acknowledgment, provide them with a copy of it. O. Reg. 235/23, s. 9.

More information can be found in RECO’s bulletins on Multiple representation and Disclosures, consents, and acknowledgements.

Your professional liability insurance renewal has begun

The professional liability insurance program administered by RECO provides essential protection for you and your clients. All registrants must be insured under the professional liability insurance program.

Additional coverage was secured this year, and the annual fee has remained unchanged since 2022.

NEW: The policy limit for the errors and omissions coverage increases effective September 1, 2025, to $2 million per claim (up from $1 million) and to $4 million annually (up from $3 million).

The deadline for registrants to make their annual $500 payment on MyWeb is August 22, 2025. Please visit RECO’s website to access additional information about your professional liability insurance renewal.

To ensure you receive all important information about this year’s insurance renewal, please be sure your email address and other information are up to date on MyWeb..

Providing services to clients in a rental transaction

Real estate boards and associations are reporting that more agents are providing services to landlords and tenants in rental transactions.

Rental transactions account for very few complaints to RECO (see complaints breakdown in article below), and not all agents engage in rental transactions.

However, for those who do, it is essential to understand that the obligations under the Trust in Real Estate Services Act, 2002 (TRESA) apply to agents' actions. The obligations at a high level are set out below.

Clarity in representation

- A representation agreement, which makes the necessary disclosure of whose interests the agent is promoting and protecting, must be in place when an agent represents a party in any transaction—including in rental transactions.

- Remember that an agent or brokerage is prohibited from representing two clients in a transaction, unless the required disclosures have been made and the clients or prospective clients have made an informed decision to proceed.

Documentation of services

- The agent and brokerage must outline all the services they will provide to and for the client in a rental transaction.

- Documentation must indicate whether the agent is negotiating the terms of the lease, preparing the standard Ontario lease agreement, showing the rental property, or qualifying tenants (including credit checks and references).

- If the agent commits to qualifying tenants for landlords, consider a third-party company that can vet tenants and source rental history. The agent should also verify all information that is provided by tenants and run active credit checks, rather than relying on printed versions of credit reports or pay stubs.

- It is just as important to outline what the client is responsible for—or at a minimum, make it clear what the brokerage/agent is not providing—to avoid misunderstandings.

- All services must be outlined in plain language so that the client can understand what they can expect the agent/brokerage to do.

Remuneration

- The representation agreement is to include clear and complete details of the remuneration.

- Remember: Agents must give and explain the RECO Information Guide before providing services to a client and to a self-represented party before providing assistance. The Information and Disclosure to Self-represented Party form must also be provided to a self-represented party participating in the transaction.

RECO shared more about registrant obligations in rental transactions in For the Record in October 2024 and again in December 2024.

Accuracy in property listings

Accuracy in property listings is imperative for agents and their clients, and misrepresentation puts agents and their clients at risk.

Misrepresentation refers to false or misleading information about a client’s property, including its size or condition. Misrepresentation can also occur when the proximity or sightlines of a client’s property is inaccurately advertised in a listing, such as proximity or access to waterfront or green space or view of the water. Engaging in or being a party to misrepresentation is prohibited under the Trust and Real Estate Services Act, 2002 (TRESA), and registrants who participate in this conduct may be subject to enforcement action.

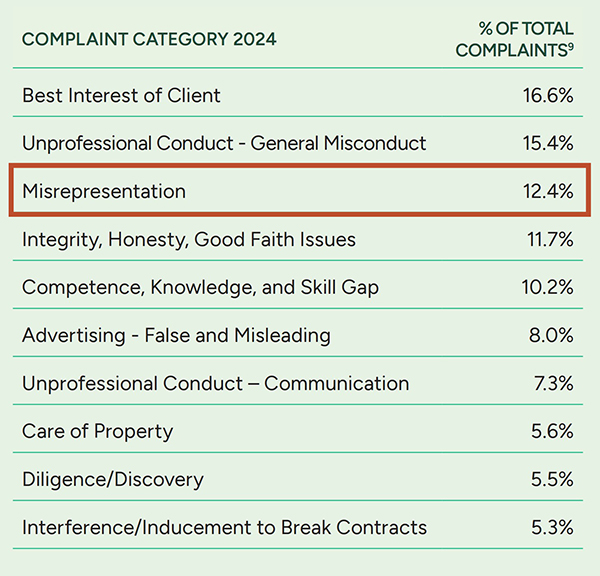

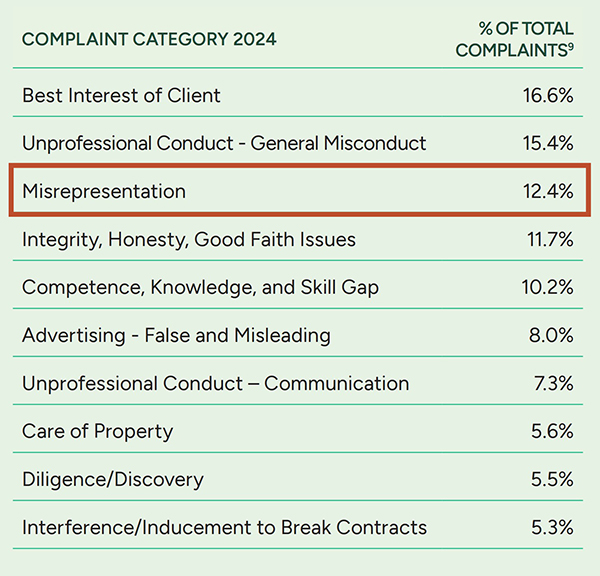

Approximately 12 per cent of complaints include a reference to misinformation. It’s important to understand how frequently this is of concern to buyers and sellers and how to prevent such complaints.

9 - The 2024 data is based on complaints closed during the year; a single complaint may involve multiple categories and therefore the total does not add up to 100 per cent.

Registrants should exercise the utmost care to confirm the accuracy and completeness of the property details that seller clients share with them.

To ensure advertisements for clients’ properties are in compliance with the law, registrants should take the following steps:

- Make every effort to confirm statements about the condition of the property, including any latent (non-visible) defects. It is important to note that if latent defects are not disclosed, buyers might pursue legal action against sellers and their agents.

- Perform due diligence to confirm a property’s location, including proximity to things such as green space, access to waterfront, schools and shopping districts, and ensure that listing details are accurate.

- Confirm legal status of a property through the relevant municipality, including basement apartments, renovation permits and property lines. Registrants, on behalf of their buyer clients, should seek a property survey, which can likely be accessed through the property owner or municipality.

- Ensure that information is accurate and up to date for items such as property taxes, condominium fees, utility costs, and other expenses. Registrants should ask seller clients for copies of recent documentation like utility or tax bills to verify the information. For property taxes, verify whether the tax bill reflects an interim amount or final/annual amount. Official documentation (not relying on second-hand information from the seller) is critical for confirming accuracy.

Remember: Misrepresentation of information, even if it’s false information from a seller or published accidentally, is still misrepresentation and is not exempt from the law.

For more information, read RECO’s bulletin on Professional conduct.

New: Farm property class tax rate program

For eligible applicants, land and buildings used for residential purposes will be taxed at the municipality’s residential tax rate, while the remainder of the farmland on the property will be taxed at no more than 25 per cent of the residential tax rate.

Farmland owners must meet specific eligibility criteria, including:

- The Municipal Property Assessment Corporation (MPAC) has assessed the property as farmland.

- The property is used for a farm business.

- The farm business on the property has a valid Farm Business Registration (FBR) number.

- The property is owned by Canadian citizens or permanent residents.

The farm property class tax rate program is administered through Agricorp. Clients with farmland properties should visit the Agricorp website to determine their eligibility and apply to the program.

MyRECO Certificate mobile app no longer supported

RECO has received some questions regarding the MyRECO Certificate mobile app, which registrants had previously used to display their registration certificates on their mobile devices.

With upgrades to mobile operating systems, this app only functioned on some devices and did not work for everyone. Registrants who have already downloaded the app and have been using it successfully on their mobile phones can continue to do so.

The app was removed from the iPhone App Store and the Google Play Store in February 2024, and RECO is assessing its future approach.

In the meantime, registrants have two ways to present their registration with RECO:

- The “View Certificate” button on the MyWeb dashboard

- The “Agent/Brokerage Search” button at the top of RECO’s website homepage

RECO Information Guide: Printer-friendly versions and updated sharing tool

Registrants must share the RECO Information Guide with potential clients before providing services or assistance. Thanks to feedback from registrants, RECO is pleased to introduce new black and white, printer-friendly versions of the guides for agents who want to produce a printed version or have clients who want to save ink when printing it for themselves.

Our printer-friendly guides include:

- RECO Information Guide (Residential - Printer-friendly version)

- Guide d'information du COI (Résidentiel - Version imprimable)

- RECO Information Guide (Commercial - Printer-friendly version)

- Guide d'information du COI ((Commerciale - version imprimable)

The RECO Information Guide online sharing tool can also be accessed directly from RECO’s primary website.

Be sure to bookmark: reco.on.ca/recoinformationguide.

More options for real estate education now available

Starting this month, individuals pursuing a career in Ontario’s real estate services sector will have more choice in where they begin their education. As part of RECO’s move to a multiple-provider education model, four post-secondary institutions have been authorized to deliver real estate education programs:

- Algonquin College

- Career College Group

- Humber Polytechnic

- Fleming College

The institutions will begin accepting new learners this summer, offering greater accessibility and flexibility across the province while upholding RECO’s high standards for real estate education.

In addition, Meazure Learning was announced last fall as RECO’s new independent exam provider. This shift to a single exam provider supports a more consistent and secure experience for learners no matter which education provider they choose.

All providers are offering fully integrated TRESA content across all courses, simulation sessions, and exams. These updates reflect RECO’s ongoing commitment to modernizing real estate education in Ontario and ensuring a strong foundation for future agents and brokers.

For more information on education, program registration dates, educational competency profiles, and more, visit reco.on.ca/learners/about-real-estate-education-in-ontario.

Statutory holiday closure

RECO’s office will be closed on Monday, September 1, 2025 for the Labour Day statutory holiday.

Thank you for participating in the 2025 RECO registrant survey

RECO’s annual registrant survey – conducted by Ipsos, a leading independent research firm – allows RECO to better understand registrants’ perspectives.

Registrant feedback is important to RECO. The survey is a valuable tool that helps RECO understand what’s working well and where a different approach may be needed. As always, the input provided will help inform future initiatives and guide RECO’s efforts to better support registrants and uphold consumer protection in Ontario’s real estate services sector.

RECO’s 2025 registrant survey closed on July 8, 2025. Thank you to all the registrants who took the time to share their input. RECO looks forward to sharing the survey results later this year.

RECO Annual General Meeting: Recording and Q&A

Thank you to everyone who participated in RECO’s Annual General Meeting (AGM) on May 29. The AGM recording is available for viewing on RECO’s website, where registrants can also find a Q&A for questions not answered at the meeting.